30% taxes in usa

-

Thought working in USA is great. But now found out taxes is 30%. Theres go my exchange rate advantage !

-

and hopefully the "exchange rate advantage" will last too.... =P

yah...after deduction for medical insurance, retirement contribution and tax...there's hardly much left over for living expenses...

bloody..the medical insurance is very high in MA??!!!!

-

It's even worse in Singapore, wages are being suppressed by foreigners, you hardly make enough to go by, let alone consider about medical insurance and retirement savings.

Due to the high influx of foreigners (government's policy to increase the population to 6.5 million), wages have been suppressed due to oversupply of labour, while prices have inflated beyond an average person's means.

The price of a 2 "bedroom" HDB (which is listed as 3 room) cost an average of $240,000. For a loan of $240,000, 30 years repayment period, interest rate of 4%, you would need to pay $1,156 per month. It would be difficult if your household income is $4,000 and you have kids and parents to feed.

-

They realised that most Singaporeans don't have enough money for retirement, so they came up with a new plan, which is a reverse mortgage plan for your HDB flat.

Singapore is just work, more work and at the end of it all, you just die.

Reverse mortgage / sale leaseback scheme

-

Originally posted by Ivan lee:

Thought working in USA is great. But now found out taxes is 30%. Theres go my exchange rate advantage !

You are combinding State and Fed? did you do the 1040ez or individual deduction?

-

Originally posted by deepak.c:

They realised that most Singaporeans don't have enough money for retirement, so they came up with a new plan, which is a reverse mortgage plan for your HDB flat.

Singapore is just work, more work and at the end of it all, you just die.

Reverse mortgage / sale leaseback scheme

and not anyone or any flat qualifies for the reverse mortgage.

ya..housing prices can be crazy in sunny singapore. but that's also how many singaporeans get rich....there are always 2 sides to the story

-

Originally posted by lostintransition:

and not anyone or any flat qualifies for the reverse mortgage.

ya..housing prices can be crazy in sunny singapore. but that's also how many singaporeans get rich....there are always 2 sides to the story

if you are flipping house than yeah you can get rich but if the house that you stayed appreciated i am not sure you can call that rich.... -

Originally posted by Arapahoe:

if you are flipping house than yeah you can get rich but if the house that you stayed appreciated i am not sure you can call that rich....

true to some extent....but one can also downgrade to a smaller place. but i do agree with you that you probably need to have more than 1 property to reap the returns.for us, we sold our private apartment and bought a small HDB flat...if not for that, we probably wouldn't sacrifice better income in singapore to come to the states....

-

Originally posted by Ivan lee:

Thought working in USA is great. But now found out taxes is 30%. Theres go my exchange rate advantage !

dude .... I was paying 38% in my first job after graduation north of the US ........

-

Both Ivan Lee and Fatum paying above 30% taxes in the US. They must be making annual income in excess of US$100,000.

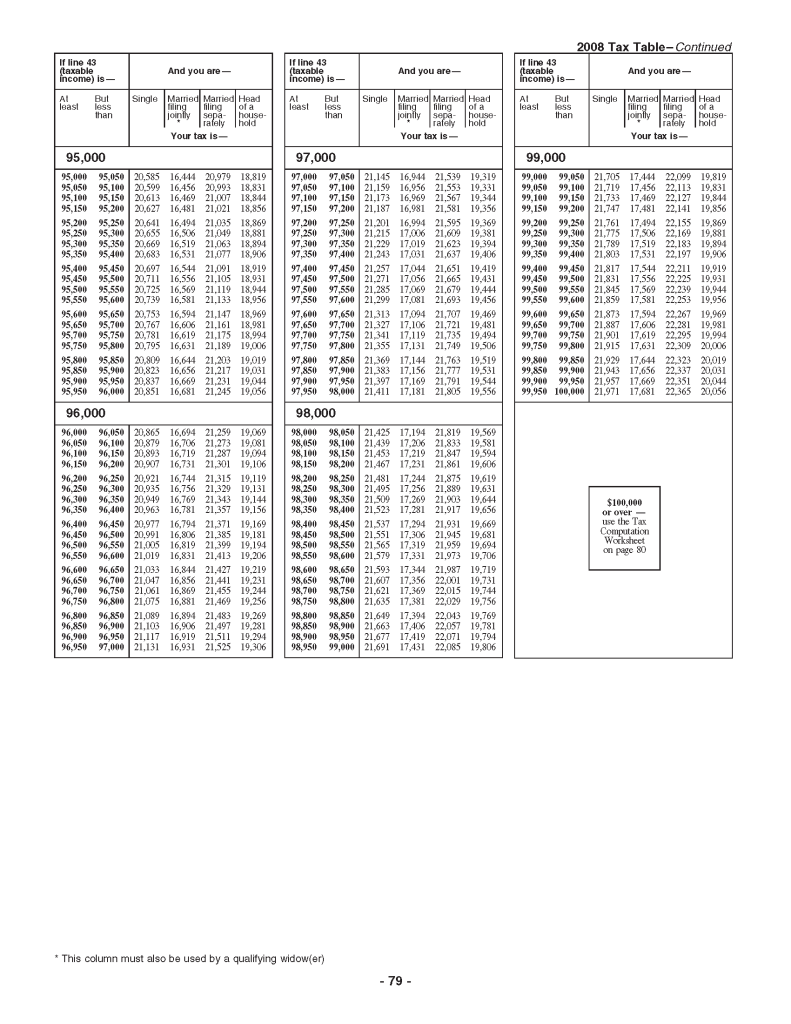

The effective tax rate for a US individual making US$100,000 is US$21,971, which means an effective tax rate of 21.97%.

You guys are rich, it's time to do your part for the less fortunate of society.

http://www.irs.gov/pub/irs-pdf/i1040tt.pdf

-

From page 80 of the table. If someone is paying 30% taxes in the USA, they would have to be making annual income in excess of US$357,700.

That comes up to about a salary of US$29,808 a month, you guys are filthy rich, time to pay your dues to society.

-

Originally posted by deepak.c:

From page 80 of the table. If someone is paying 30% taxes in the USA, they would have to be making annual income in excess of US$357,700.

That comes up to about a salary of US$29,808 a month, you guys are filthy rich, time to pay your dues to society.

You forgot to factor state taxes into the overall tax burden for an individual in this country. Throw property taxes and sales taxes into the mix, and your effective tax rate will likely exceed 30% of your gross annual income.

-

Originally posted by Meia Gisborn:

You forgot to factor state taxes into the overall tax burden for an individual in this country. Throw property taxes and sales taxes into the mix, and your effective tax rate will likely exceed 30% of your gross annual income.

But seriously, to be taxed above 30% means the income would have to be above US$100,000 a year.

-

Originally posted by deepak.c:

But seriously, to be taxed above 30% means the income would have to be above US$100,000 a year.

It's easy to find yourself in that tax bracket even if you're making less than US$100,000 if you live in a state with high state income and/or property taxes. Keep in mind that these taxes aren't uniform across all states.

Many married couples have household incomes exceeding US$100,000. If they file a joint return, it is not inconceivable that their tax liability will exceed 30% of their combined gross annual income when the other taxes (state, property and sales) are factored in.

-

Originally posted by Meia Gisborn:

It's easy to find yourself in that tax bracket even if you're making less than US$100,000 if you live in a state with high state income and/or property taxes. Keep in mind that these taxes aren't uniform across all states.

Many married couples have household incomes exceeding US$100,000. If they file a joint return, it is not inconceivable that their tax liability will exceed 30% of their combined gross annual income when the other taxes (state, property and sales) are factored in.

If you are married and do not gain tax advantage, it would be downright stupid to be filing a joint return.

I was comparing singles, not joint or separate filing.

But you have not factor in the indiscrimitory GST in Singapore and the property taxes, radio & TV license & water tariff. You don't get to deduct medical bills (e.g. spectacles, medicine, medical procedures, etc) from your gross income to derive at your taxable income. You don't get to deduct medical bills off your gross income in Singapore. GST in Singapore is a flat out on all products and services, in USA (in some states) sales taxes are not applied to clothing, food and medication.

What's the highest sales tax in US? California? 8.25%? Even then, they have sales tax exemption of basic food items. In Singapore it's a flat out 7% GST on everything.

"In grocery stores, unprepared food items are not taxed but vitamins and all other items are. Ready-to-eat hot foods, whether sold by supermarkets or other vendors, are taxed. Restaurant bills are taxed. As an exception, hot beverages and bakery items are tax-exempt if and only if they are for take-out and are not sold with any other hot food. If consumed on the seller's premises, such items are taxed like restaurant meals. All other food is exempt from sales tax."

http://en.wikipedia.org/wiki/Sales_taxes_in_the_United_States

Food takes up a high percentage of our income (for low income earners), if basic food products are exempt from sales tax, it would have taken a huge burden.

But with the higher taxes you guys also derive certain benefits, if you are structurally unemployed, you get to claim unemployment cheques. Singapore, if you are structurally unemployed, you just have to beg, borrow or steal.

-

I am not too sure about US tax system, but did you make a mistake with the term joint filing and separate filing.

In Singapore, joint filing is the combined income of the couple as an individual. If you compare the joint filing and separate filing in the tax table I posted above, you will notice that joint filing has a lower tax than separate filing.

-

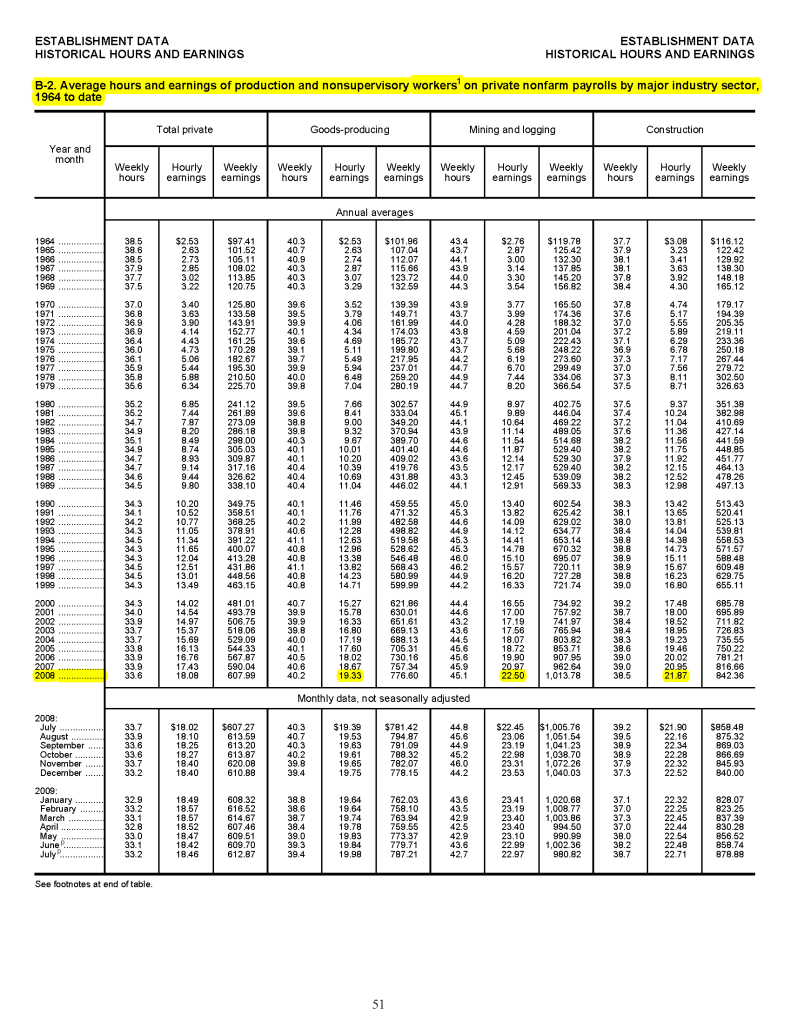

You also can't make a fair comparison without taking into account the worker's wage both in Singapore and USA. The figures posted are from BLS, it is the average earnings of production and non-supervisory workers on private nonfarm payrolls.

For goods producing industry it's US$19.33/hour and construction industry is US$21.87. I can add mining and logging for comparison because Singapore doesn't have a mining and logging industry.

Higher wages coupled with higher taxes, it's still manageable. Lower wages but slightly better than higher taxes, it would be difficult.

How much do you think our workers in manufacturing and construction industry get?

Maybe slightly better than a PRC worker (in the future), afterall our main labour force is PRC.

If you guys really think that the higher wages with higher taxes are difficult to survive in the US, then perhaps you should come back to Singapore, have PRC wages and work hours, but you get slightly lower taxes. We welcome back the locally born Singaporeans to help us combat the PRC invasion with open arms.

-

Originally posted by deepak.c:

If you are married and do not gain tax advantage, it would be downright stupid to be filing a joint return.

I was comparing singles, not joint or separate filing.

But you have not factor in the indiscrimitory GST in Singapore and the property taxes, radio & TV license & water tariff. You don't get to deduct medical bills (e.g. spectacles, medicine, medical procedures, etc) from your gross income to derive at your taxable income. You don't get to deduct medical bills off your gross income in Singapore. GST in Singapore is a flat out on all products and services, in USA (in some states) sales taxes are not applied to clothing, food and medication.

What's the highest sales tax in US? California? 8.25%? Even then, they have sales tax exemption of basic food items. In Singapore it's a flat out 7% GST on everything.

"In grocery stores, unprepared food items are not taxed but vitamins and all other items are. Ready-to-eat hot foods, whether sold by supermarkets or other vendors, are taxed. Restaurant bills are taxed. As an exception, hot beverages and bakery items are tax-exempt if and only if they are for take-out and are not sold with any other hot food. If consumed on the seller's premises, such items are taxed like restaurant meals. All other food is exempt from sales tax."

http://en.wikipedia.org/wiki/Sales_taxes_in_the_United_States

Food takes up a high percentage of our income (for low income earners), if basic food products are exempt from sales tax, it would have taken a huge burden.

But with the higher taxes you guys also derive certain benefits, if you are structurally unemployed, you get to claim unemployment cheques. Singapore, if you are structurally unemployed, you just have to beg, borrow or steal.

Certain tax credits and adjustments, such as child and dependent care credit, adoption expense credit and deductions for qualified educational loan interest (there are probably others, but these are the more common ones), are only available if you file a joint return with your spouse. The child and dependent care credit, in particular, is very popular amongst families with young children.

You are correct: California's sales tax rate of 8.25% currently makes it the highest in the nation.

With regard to tax deductions for medical bills, the IRS currently only allows you to deduct the portion of your medical expenses exceeding 7.5% of your adjusted gross income, and only if you itemize the deductions. It's a nice benefit, but if your medical expenses are that high, you definitely have other things to worry about!

I am curious about one thing: has anyone in Singapore ever calculated the effective tax rate as a percentage of gross income, that factors in all the various taxes (income tax, GST, etc.) that a person living and working there would expect to pay at various income levels? Aside from my NS stint, I've never worked in Singapore and am unfamiliar with the tax situation there.

-

Originally posted by deepak.c:

In Singapore, joint filing is the combined income of the couple as an individual. If you compare the joint filing and separate filing in the tax table I posted above, you will notice that joint filing has a lower tax than separate filing.

The joint filing tax rates are lower, but the combined adjusted gross income will likely be higher and result in about the same amount of tax paid.

I'm looking at the 2008 tax tables in my 1040 booklet right now (you can probably get to the same information on the IRS website). Let's assume a married couple, each having a taxable income of $35,000:

If each filed separately, they would each be paying $5,100 to the IRS, for a total of $10,200.

If they filed a joint return with a combined taxable income of $70,000, they would be paying $10,194 to the IRS.

So whether you file separately or jointly, the total tax burden would be about the same; the tax tables make sure of that.

-

*cracking under the CA tax rate burden*

-

Originally posted by jetta:

*cracking under the CA tax rate burden*

The "California Dream" comes at a high price, doesn't it?

-

But how many times more salary are you guys getting compared to Singaporeans?

If you really think US is that bad, come back to Singapore and we can compete for lower wages with PRCs.

-

deepak.c - Do you live, or have ever lived in the US? If not, those of us who do know that your quotes of the stuff you find online isn't accurate. And this thread isn't about PRCs or anything besides noting the high taxes we have in the US, so there's really no need to get worked up about it.

One huge thing to note about making $$$ off flipping houses in Singapore...NO CAPITAL GAINS TAX!!!

I was just in LA last weekend and met up with a buddy of mine who's lived there for the last 15 years. We were both lamenting about how our friends in SG have sooo much more disposable income than we do here in the US, just so much more cash-rich.

We surmised that the fact that Sporeans mostly live with their parents till their 30s or so, so it's a long time to not pay rent/mortgage. Besides, when they do get a place of their own, the CPF handles that so there's usually no out of pocket mortgage payments like us. And then we have to contend with property taxes!

With the inevitable devaluation of the us$ in the near future, coupled with high inflation, medical costs, and a bankrupt Soc Sec fund...it's time to hit the Mega-millions, it's up to $122,000,000!

-

Originally posted by Meia Gisborn:

Certain tax credits and adjustments, such as child and dependent care credit, adoption expense credit and deductions for qualified educational loan interest (there are probably others, but these are the more common ones), are only available if you file a joint return with your spouse. The child and dependent care credit, in particular, is very popular amongst families with young children.

You are correct: California's sales tax rate of 8.25% currently makes it the highest in the nation.

With regard to tax deductions for medical bills, the IRS currently only allows you to deduct the portion of your medical expenses exceeding 7.5% of your adjusted gross income, and only if you itemize the deductions. It's a nice benefit, but if your medical expenses are that high, you definitely have other things to worry about!

I am curious about one thing: has anyone in Singapore ever calculated the effective tax rate as a percentage of gross income, that factors in all the various taxes (income tax, GST, etc.) that a person living and working there would expect to pay at various income levels? Aside from my NS stint, I've never worked in Singapore and am unfamiliar with the tax situation there.

I was having dinner in Long Beach last week, and the sales tax was 9.75%!!! I had to ask the waiter to confirm it...way to go governator.

-

Originally posted by Boomslang4829:

One huge thing to note about making $$$ off flipping houses in Singapore...NO CAPITAL GAINS TAX!!!

it's not so easy now...the SG govt is planning to tax those who had sold another property within the last 4 years